The Of San Diego Home Insurance

The Of San Diego Home Insurance

Blog Article

Get the Right Security for Your Home With Tailored Home Insurance Policy Protection

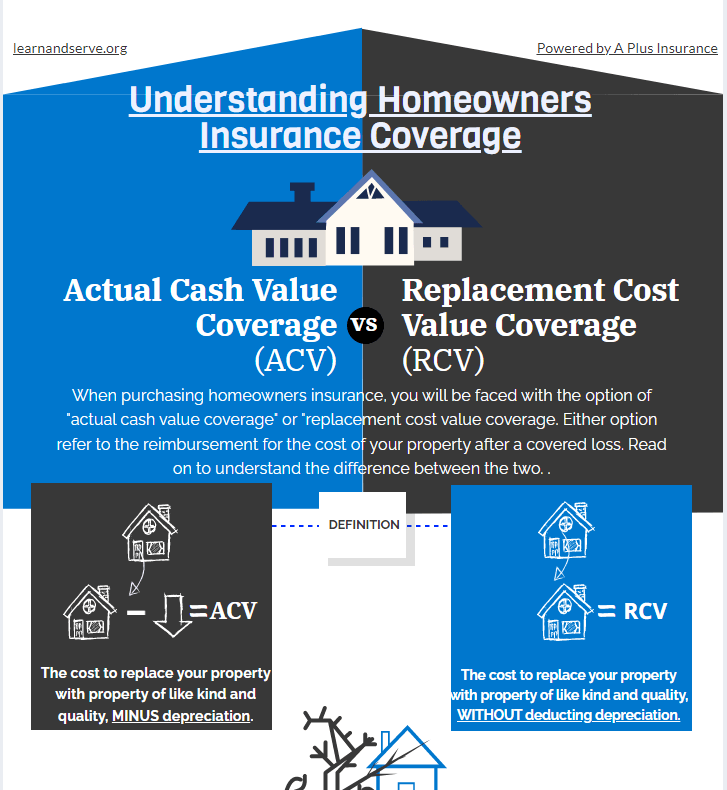

In a world where unpredicted circumstances can interfere with the serenity of our homes, having the right defense in area is extremely important. Tailored home insurance protection provides a safeguard that can offer comfort and monetary safety in times of dilemma. However, browsing the intricacies of insurance plan can be daunting, particularly when trying to establish the precise coverage your special home requires. This is where the value of personalizing your insurance plan to match your specific needs ends up being apparent. By understanding the details of plan alternatives, insurance coverage restrictions, and insurance company reliability, you can guarantee that your most substantial investment-- your home-- is appropriately safeguarded.

Relevance of Tailored Home Insurance Coverage

Crafting a customized home insurance plan is vital to ensure that your insurance coverage properly reflects your private requirements and circumstances. A tailored home insurance plan surpasses a one-size-fits-all strategy, providing you particular protection for your special circumstance. By functioning closely with your insurance policy supplier to customize your policy, you can ensure that you are properly covered in case of an insurance claim.

One of the vital advantages of tailored home insurance policy is that it permits you to consist of coverage for products that are of specific worth to you. Whether you have costly jewelry, unusual art work, or customized tools, a tailored plan can make certain that these belongings are safeguarded. Additionally, by tailoring your protection, you can change your deductibles and limits to align with your threat tolerance and monetary capabilities.

Furthermore, a personalized home insurance plan takes into consideration variables such as the area of your building, its age, and any kind of distinct functions it may have. This customized strategy helps to reduce possible spaces in insurance coverage that might leave you subjected to dangers. Ultimately, spending the moment to tailor your home insurance coverage policy can supply you with assurance knowing that you have thorough defense that meets your specific requirements.

Examining Your Home Insurance Needs

When considering your home insurance needs, it is critical to assess your private situations and the specific dangers related to your residential or commercial property. Start by examining the worth of your home and its components. Take into consideration the area of your residential or commercial property-- is it prone to all-natural calamities like hurricanes, floods, or quakes? Examine the criminal activity price in your area and the possibility of theft or criminal damage. Examine the age and problem of your home, as older homes might require even more upkeep and might be at a higher danger for concerns like pipes leakages or electrical fires.

Furthermore, take into account any type of extra structures on your residential or commercial property, such as sheds, garages, or pool, that may require insurance coverage. Consider your liability dangers as a home owner, consisting of the potential for mishaps to occur on your building. By extensively evaluating these variables, you can establish the level of protection you need to adequately safeguard your home and possessions (San Diego Home Insurance). Remember, home insurance coverage is not one-size-fits-all, so tailor your policy to meet your details demands.

Customizing Insurance Coverage for Your Home

To customize your home insurance coverage properly, it is crucial to tailor the protection for your specific residential property and individual demands. When tailoring protection for your residential or commercial property, take into consideration factors such as the age and building and construction of your home, the value of your possessions, and any kind of distinct features that might require special coverage. For example, if you own pricey fashion jewelry or art work, you may need to include additional coverage to secure these things effectively.

In addition, the area of your home plays a vital duty in tailoring your insurance coverage (San Diego Home Insurance). Homes in areas susceptible to natural catastrophes like earthquakes or floods may need extra insurance coverage not consisted of in a conventional policy. Understanding the dangers linked with your location can help you tailor your coverage to mitigate possible damages effectively

Additionally, consider your lifestyle and personal preferences when tailoring your insurance coverage. If you regularly travel and leave your home empty, you may wish to add insurance coverage for burglary or criminal damage. By customizing your home insurance coverage to suit your certain needs, you can make certain that you have the ideal protection in position for your home.

Recognizing Plan Options and Boundaries

Exploring the numerous policy choices and restrictions is essential for gaining an extensive understanding of your home insurance policy protection. Policy alternatives can consist of coverage for the structure of your home, individual belongings, responsibility defense, extra living costs, and extra. By very closely examining policy choices and restrictions, you can tailor your home insurance protection to give the security you require.

Tips for Selecting the Right Insurer

Recognizing the relevance of selecting published here the right insurance company is extremely important when guaranteeing your home insurance coverage straightens perfectly with your needs and offers the necessary security for your assets. When choosing an insurance company for your home insurance coverage plan, take into consideration factors such as the firm's online reputation, economic stability, customer support high quality, and protection choices. Research the insurer's history of dealing with claims without delay and rather, as this is important in times of need. Look for any type of evaluations or problems online to gauge client fulfillment levels. It's additionally recommended to compare quotes from numerous insurance providers to guarantee you are obtaining competitive rates for the insurance coverage you require. One more suggestion is to analyze the insurance provider's determination to customize a plan to fit your particular needs. A good insurance company should be transparent about what is covered in the plan, any type of exclusions, and the procedure for submitting an insurance claim. By complying with these tips, you can make an informed decision try this out and pick the ideal insurance company for your home insurance coverage requires.

Verdict

Crafting a personalized home insurance policy is crucial to ensure that your insurance coverage accurately reflects your specific requirements and circumstances (San Diego Home Insurance). Evaluate the age and problem of your home, as older homes may require more maintenance and could be at a higher risk for issues like plumbing leaks or electric fires

To tailor your home insurance coverage plan efficiently, it is necessary to tailor the insurance coverage for your specific residential or commercial property and individual requirements. When tailoring coverage for your building, think about factors such as the age and building of your home, the worth of your items, and any kind of unique functions that may require special protection. By closely analyzing Learn More plan choices and limits, you can customize your home insurance policy protection to supply the defense you need.

Report this page